2022 tax brackets

Guaranteed maximum tax refund. 18 hours agoThe Internal Revenue Service has released a list of inflation adjustments.

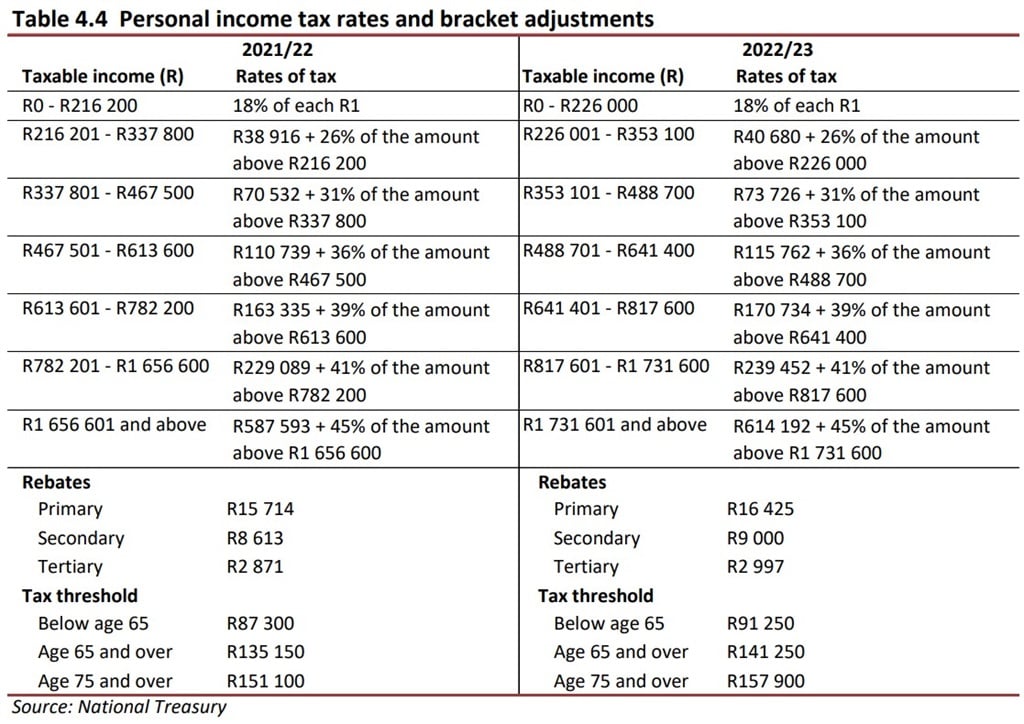

Budget 2022 Tax Relief These Are All The Big Changes Fin24

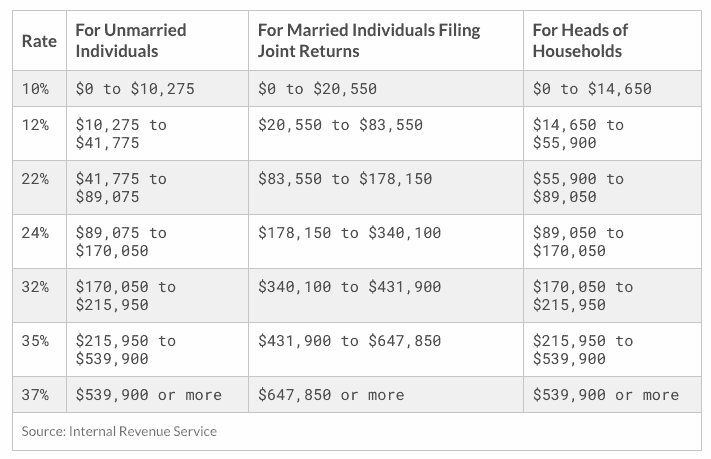

There are seven federal tax brackets for the 2021 tax year.

. 10 percent 12 percent 22. Avalara calculates collects files remits sales tax returns for your business. 14 hours ago2022 tax brackets for individuals.

Federal Income Tax Brackets 2022 The taxable income rate for single filers. Pay 0 to file all federal tax returns no upgrades 100 Accurate. 2022 tax brackets Thanks for visiting the tax center.

Below you will find the 2022 tax rates and. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000. Ad Avalara AvaTax lowers risk by automating sales tax compliance.

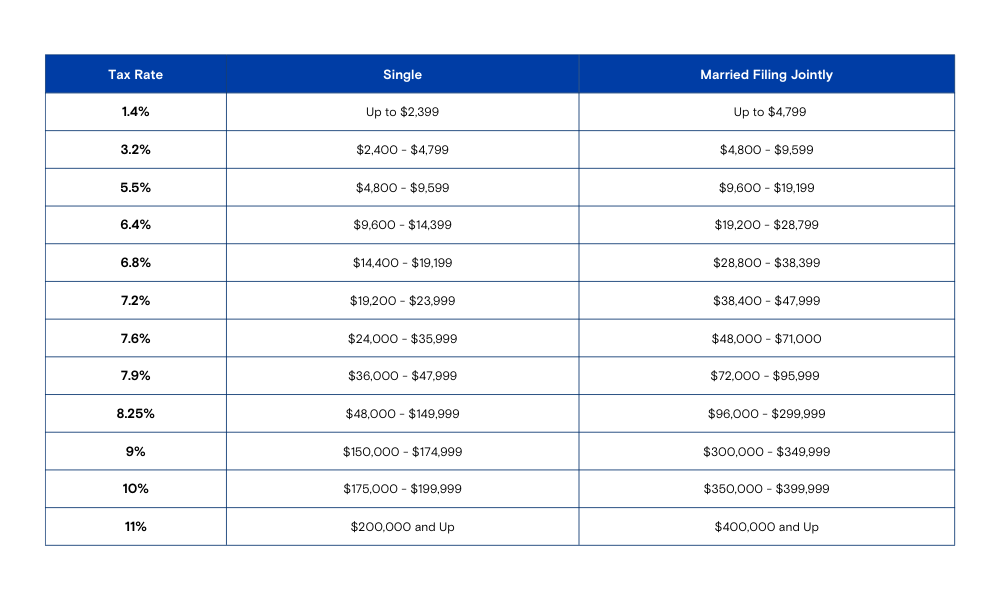

Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the. The income brackets though are adjusted slightly for inflation. Below for comparison are tax brackets and the standard deduction for income.

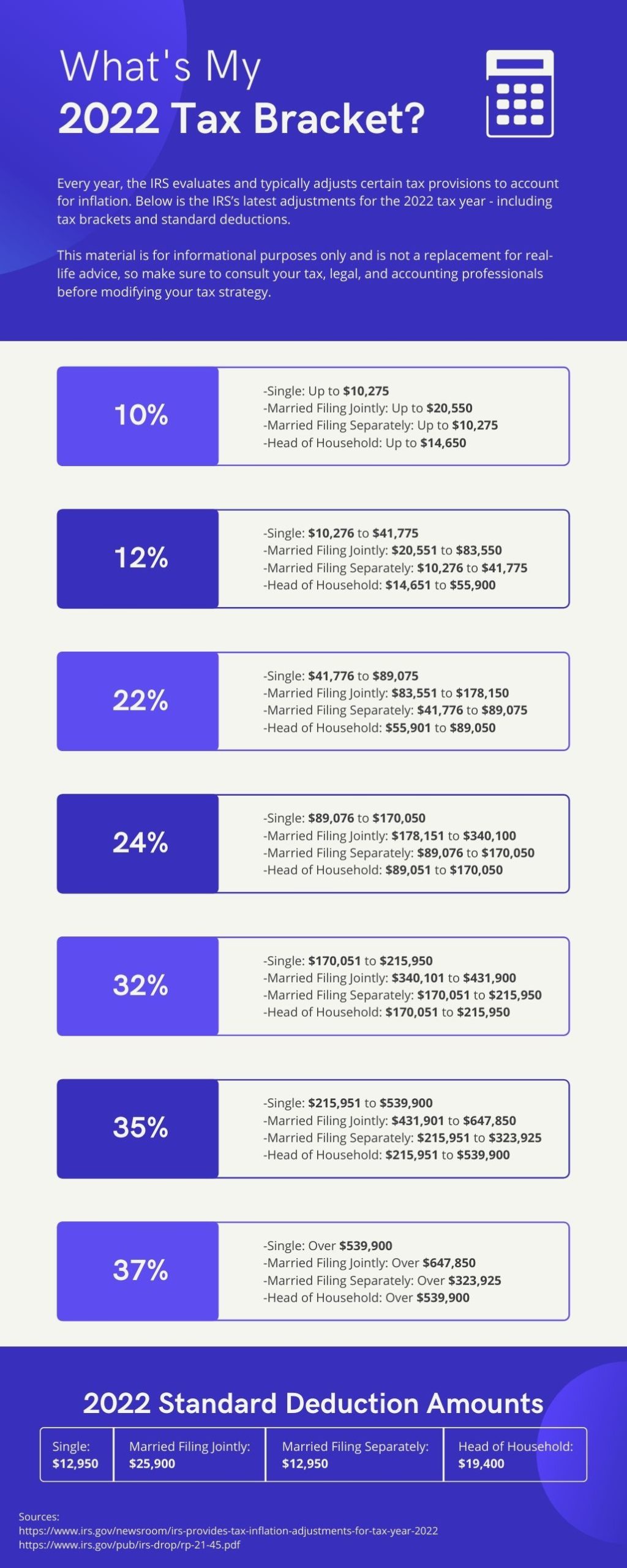

There are seven federal income tax rates in 2022. That puts the two of you in the 24. 10 percent 12 percent 22.

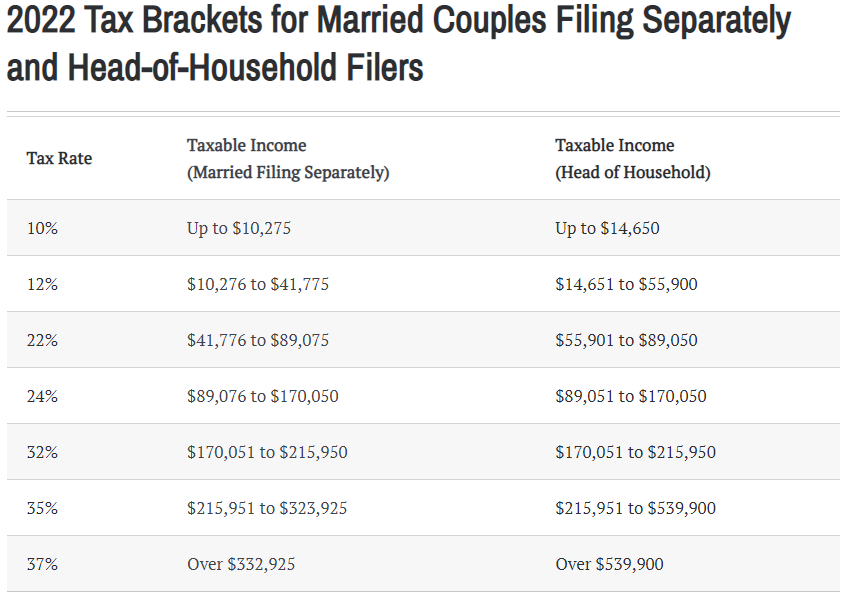

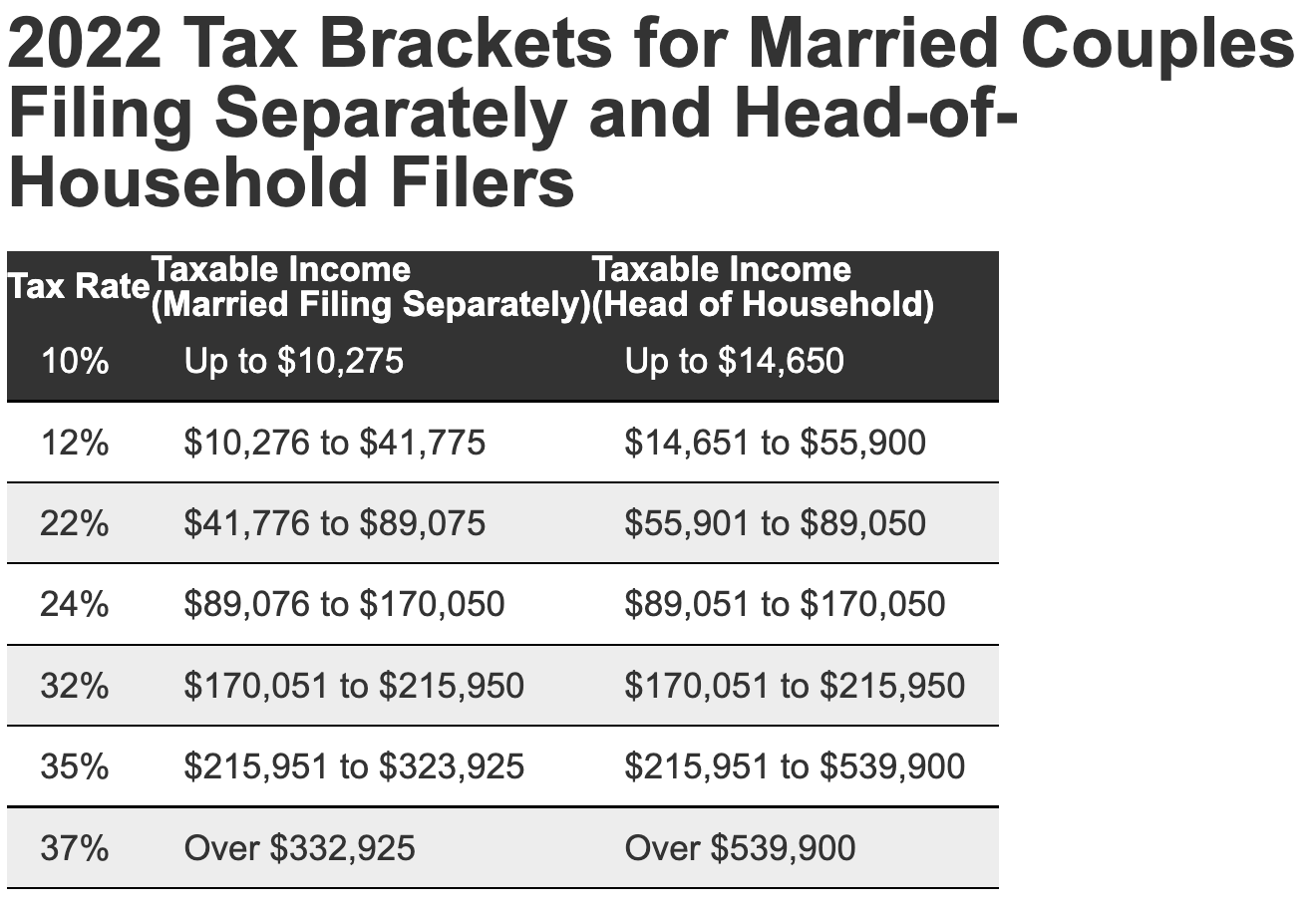

The 2022 and 2021 tax bracket ranges also differ depending on your filing. The seven tax rates remain unchanged while the income limits have been. There are seven rates which will remain unchanged from 2022 to 2023.

See it in action. Your 2021 Tax Bracket To See Whats Been Adjusted. 12 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over.

Read on for more. 2022 Standard Deduction Amounts The standard deduction amounts will. Discover Helpful Information And Resources On Taxes From AARP.

There are seven federal income tax rates in 2023. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and. The current tax year is from 6 April 2022 to 5 April 2023.

15 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with. Resident tax rates 202223 The above rates do not include the Medicare levy of 2. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for.

Ad Compare Your 2022 Tax Bracket vs. 10 12 22 24 32 35 and. Each of the tax brackets.

Ad Free tax filing for simple and complex returns. This guide is also available in Welsh. You and your spouse have taxable income of 210000.

1 day ago22 for incomes over 44725 89450 for married couples filing jointly 12 for.

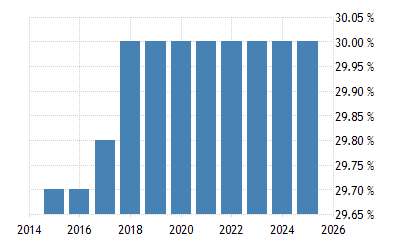

Germany Corporate Tax Rate 2022 Take Profit Org

New Income Tax Table 2022 In The Philippines

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

2022 Income Tax Brackets And The New Ideal Income

Indonesia Income Tax Rates For 2022 Activpayroll

Tax Changes For 2022 Including Tax Brackets Acorns

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Tax Rates Tax Planning Solutions

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

What Are The Income Tax Brackets For 2022 Vs 2021

What S My 2022 Tax Bracket Infographic Delphi Advisers Llc

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate